- Locking during the a favorable rates

- Overseeing financial trend

- Asking regarding the a lot more applications along with your financial

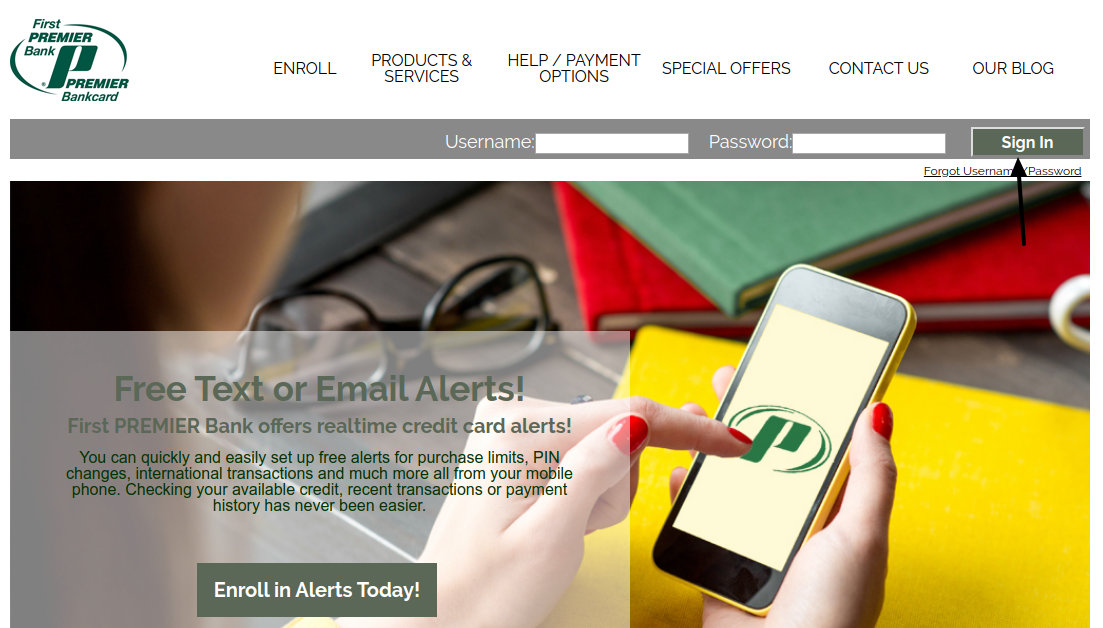

While consumers do not have the same number of manage while they have which have a normal financial, discover measures most of the borrower usually takes to be certain they snag an educated price and you will terms centered on her circumstances.

The initial step is to utilize that have a skilled, reputable mortgage lender that will assist suit your personal finances and you may goals to the correct financing alternatives.

We vow getting your ex lover and you will suggest through the each step, making certain you understand the latest terms and you will requirements with the it mortgage.

- 62 or older

- House is the key quarters

- HUD-accepted assets types, eg unmarried-friends land, apartments otherwise townhomes

- Complete contrary financial counseling from an excellent HUD-recognized counselor

- Significant equity of your property

- Including any bank-depending credit, money otherwise advantage standards

Just remember that , an other mortgage loan does not be due if you don’t get out, promote the house, perish otherwise neglect to take care of the family or spend taxes and you may insurance rates. You may also pay the mortgage any moment for folks who so choose.

If you were to think your qualify for an effective HECM, incorporate now which have Compass Mortgage or call us within (877) 677-0609 to speak in order to that loan administrator.

Secret Takeaways

An opposite financial is a kind of financing having residents aged 62 and elderly. It enables you to move a portion of your own house’s collateral on cash.

Particular requirements need to be fulfilled so you’re able to qualify for a reverse home loan, as well as getting your own house and having enough collateral.

An opposing financial makes it possible to pay-off debt and you can real time so much more properly during the later years. However it is crucial that you score all the facts before signing into the dotted range.

Related Subject areas

If you need more funds to pay for medical care will set you back and you will other needs during old-age, you are wondering in the event that a reverse home loan is the respond to. Taking right out an opposing financial is a big decision. Before you could operate, it is vital to learn more about exactly what a reverse mortgage is actually and exactly how it works.

What’s a reverse home loan?

An opposing home loan was an alternate particular financing to own homeowners old 62 and you will old. They enables you to move area of the security on the domestic towards cash without the need to sell it or build even more monthly payments. But as opposed to a conventional household equity loan otherwise next home loan, you don’t have to repay the mortgage unless you often no lengthened use the family as your first quarters-or you don’t meet with the financing personal debt.

Reverse mortgage loans are capable of the elderly who already very own good house. They’ve got both paid back it off entirely or enjoys high security-at the very least fifty% of your own property’s really worth.

You will find different varieties of contrary mortgages with various percentage steps, but most try House Collateral Conversion process Mortgages (HECM). Such money are insured from the Government Houses Administration (FHA). Brand new FHA maintains tight contrary home loan criteria to aid include each other consumers and https://availableloan.net/payday-loans-ar/ you may loan providers.

Why does an other financial really works?

An opposing financial try a twist with the a traditional financial, in which you pull out that loan and you can shell out your own bank for each month. Having a reverse home loan, obtain a loan where you borrow secured on the fresh new guarantee of your house. There are no monthly dominating and you can desire costs. As an alternative, the mortgage is actually changed into monthly payments to you. So it currency are able to be used to pay off financial obligation otherwise financing crucial prices-of-living expenses such as well as medical expense. Contrary mortgage loans essentially are not used for getaways or other “fun” expenses.